The Chief Financial Officer of a company, defined in general terms, is the person who oversees all the financial functions of a business. While the role of the CFO is much more complex and multi-faceted, financial oversight is the CFO’s core role.

The CFO does not perform the company’s accounting, or other basic functions such as customer billing and accounts receivable, accounts payable, bank reconciliations, administration of employee benefits, internal office and administrative functions, payroll support, and business insurance. The CFO does, however, monitor all these functions and systems to ensure that they are streamlined and accurate, that financial results are clear and effectively analyzed and able to be used to understand the financial performance of the business.

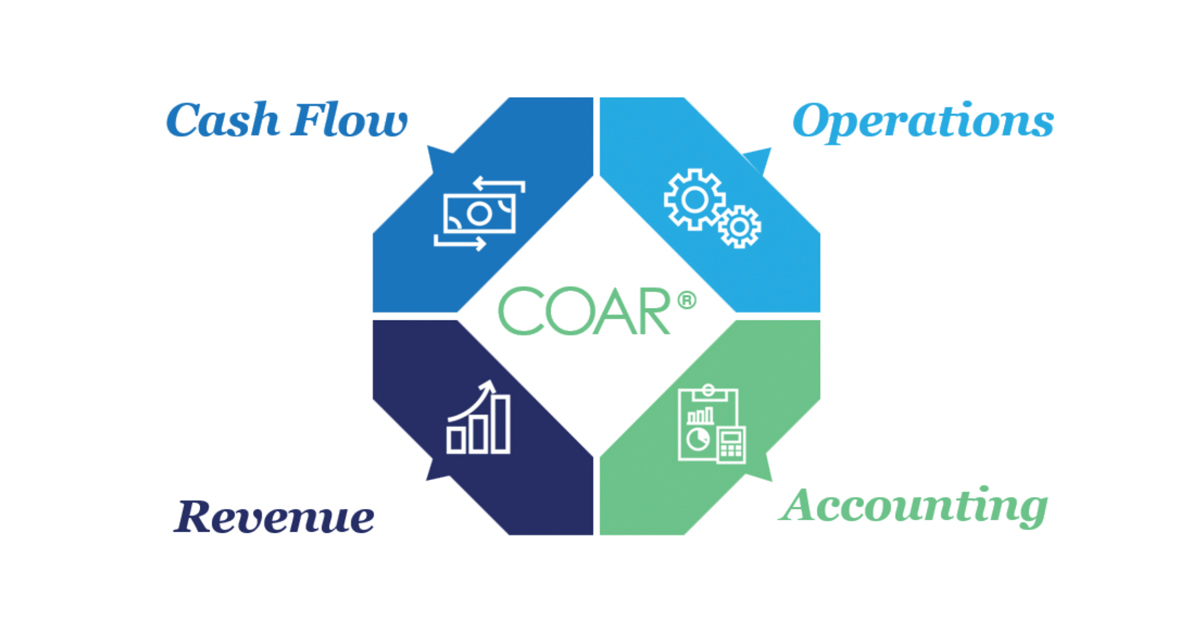

COARTM Business Systems

At a higher level, the financial oversight role of the CFO is more strategic. At FocusCFO, a balanced approach is used focusing on the Four COARTM Business Systems: Cash Flow, Operations, Accounting and Revenue. By having tools and systems in place in each of these areas, businesses can operate at an optimal level, and maximize internal cash flow.

Examples of the application of COAR include:

- Driving internal cash flow by actively managing working capital and improving product and service line profitability

- Providing regular operations reporting, focusing on key performance indicators and operating data

- Ensuring that all internal accounting and management reporting is timely and accurate

- Developing tools to measure and manage revenue, including the sales pipeline

- Improving the flow of financial and other information between the business and its banker,CPA and other key advisors

In addition to building tools to ensure that the company is operating at an optimal level, the CFO will develop ongoing forecasting, planning and analysis tools in of the all key business areas in order to work collaboratively with the CEO to build a strategic growth plan for the company.

Don Cain of FocusCFO describes the role of the CFO as “overseeing the entire financial structure of the company to manage the financial needs of the business based on its plans and goals, and to anticipate the future financial needs of the business. The CFO forecasts the future of the business to shape its strategic direction.”